The Fed's unique structure helps insulate it from short-term political pressures and balance different interests–national and regional, public and private. It is an independent central bank in that neither the president nor Congress has to approve its monetary policy decisions. At the same time, the Federal Reserve works within the government in the sense that it formulates monetary policy to achieve overall goals that Congress and the president set.

To limit the influence of day-to-day political considerations, the Fed operates on its own earnings rather than on congressional appropriations, and the members of its Board of Governors are appointed for long, staggered terms. The Fed's unique structure also provides internal checks and balances, ensuring that no one part of the system dominates its decisions and operations.

The Board of Governors

The Board of Governors, located in Washington, D.C., is an independent federal government agency that oversees the Federal Reserve System. The president appoints seven members to serve on the Board for staggered 14-year terms and designates two of them to be chair and vice chair for four-year, renewable terms. These appointments are subject to Senate confirmation. The Board members, along with the Reserve Bank presidents, participate in formulating monetary policy through the Federal Open Market Committee (see below). The Board has sole responsibility for setting reserve requirements for depository institutions and approves discount rate changes proposed by Reserve Bank directors.

Board members testify frequently before congressional committees and meet regularly with the president's Council of Economic Advisers and other key economic officials.

The Board establishes and administers financial safety and soundness and consumer protection regulations and administers regulations regarding bank consolidation. The Board also oversees Reserve Banks' services to depository institutions, bank supervision functions, and accounting procedures, and it also approves Reserve Banks' budgets.

Federal Reserve Banks

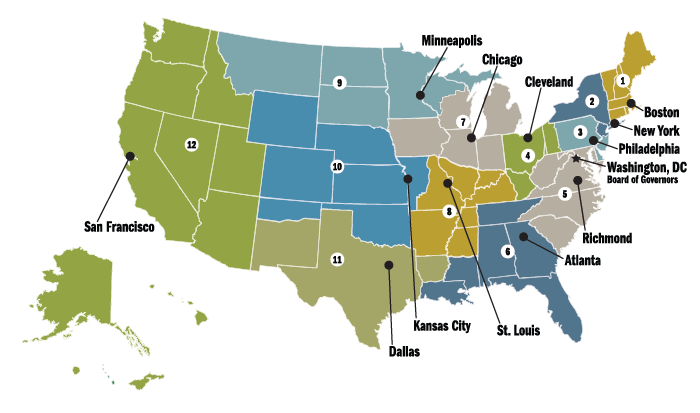

The 12 Federal Reserve Banks are the decentralized element of the U.S. central bank. They are located in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco. Branches are in 24 other cities. Each Federal Reserve Bank is separately incorporated, with a board of nine directors. Reserve Bank directors, under the supervision of the Board of Governors, oversee their bank's operations and appoint and recommend salaries of the bank's president and first vice president. Directors establish the interest rate charged on short-term loans to financial institutions through the discount window, subject to approval by the Board of Governors. Additionally, they provide a wealth of information on economic conditions in the region, which the FOMC incorporates into its monetary policy decisions.

Reserve Bank directors are evenly divided among three classes. Commercial banks that are members of the Federal Reserve System elect Class A directors to represent banks and Class B directors to represent the public. The Board of Governors chooses the remaining three Class C directors—who also represent the public—and designates two people from that group to serve as chair and deputy chair.

Directors serve staggered three-year terms. Class B and C directors cannot be officers, directors, or employees of a bank or bank holding company. Additionally, Class C directors cannot own stock in a bank or bank holding company.

The boards of directors at the Reserve Bank branches have five or seven directors. Head-office directors appoint the majority of them, and the Board of Governors appoints the rest.

As operating arms of the U.S. central banking system, the Reserve Banks perform a variety of functions, including

The Reserve Banks also fulfill an important role in the districts they serve by conducting research on the regional, national, and international economies and disseminating information to the public through publications, speeches, and economic education programs.

Reserve Banks generate their own income, which comes mainly from interest on government securities acquired through open market operations. Each year, after paying expenses, the Reserve Banks turn over their earnings to the U.S. Treasury.

Federal Open Market Committee

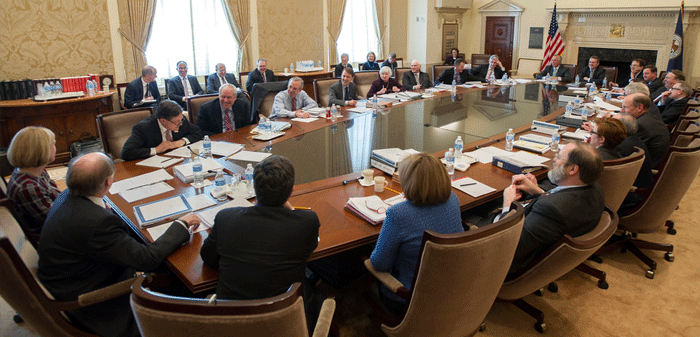

The Federal Open Market Committee (FOMC) is the Fed's principal monetary policymaking body. It directs open market operations, the most important tool of monetary policy. The Committee's 12 voting members consist of the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four Reserve Bank presidents, who serve one-year terms on a rotating basis.

Three committees advise the Board of Governors, providing information on various groups affected by Fed policies.

Advisory committees at the individual Reserve Banks advise the banks on these and other interests at the regional level.

All Reserve Bank presidents participate in the meetings by bringing up-to-date economic information from their districts and offering their views on the economic outlook. Traditionally, the chair of the Board of Governors also chairs the FOMC, and the president of the New York Fed serves as vice chair.

The Committee meets in Washington, D.C., eight times a year and holds additional meetings or telephone consultations as needed.