Add to cart, add to your phone, add to your favourite apps – cashback for your online lifestyle.

Score up to 10% in cashback with the FRANK Credit Card, which now lets you earn more when you spend across categories.

Get 10% off SG Comic Con tickets!

![]()

-->

From 8 May 2023, the interest rate applied to the outstanding balance for all OCBC credit cards will be 27.78% instead of 26.88% per annum. If the minimum amount is not paid by the due date, a higher interest rate of 30.78% per annum will apply.

Earn 8% in cashback on all local online purchases, or on purchases made in foreign currency at your favourite stores.

Earn an additional 2% when you shop at selected green merchants like Scoop Wholefoods, Little Farms and more!

Earn 8% in cashback when you pay with your smartphone or watch � via Apple Pay, Samsung Pay, Google Pay or Garmin Pay � in stores.

Plus, earn an extra 2% in cashback when you make contactless payment at selected green merchants like SimplyGo, BlueSG and more!

Lock your card, request for a new one and report suspicious transactions via OCBC Mobile Banking app

Track the ins and outs of your money each month

![]()

Online payments are now made easy when you Click to Pay with Visa. Visa Cardmembers can now simply select the Click to Pay icon upon checkout and that�s it!

![]()

Online payments are now made easy when you Click to Pay with Visa. Visa Cardmembers can now simply select the Click to Pay icon upon checkout and that�s it!

Receive up to S$100 in cashback each month � just spend at least S$800 a month online or in any store that accepts contactless mobile payment.

![]()

Online purchases made in SGD

Purchases made via Apple Pay, Samsung Pay, Google Pay or Garmin Pay in SGD

![]()

![]()

![]()

![]()

To enjoy the above, you must spend at least S$800 a month. If you spend less than that, you will earn a flat 0.3% in cashback.

See terms and conditions

![]()

Online spending

In-store mobile contactless payments ![]() / foreign currency spending

/ foreign currency spending ![]()

![]()

Other spending

Total spending

Terms and conditions apply.

15% off site-wide

1-for-1 Over Acai Bowl

7% off with min. 7 days rental

S$1 off and more

Minimum spending of S$10,000 in one year, starting from the month after your FRANK Credit Card was issued ($0 annual fees for the first 2 years)

Others

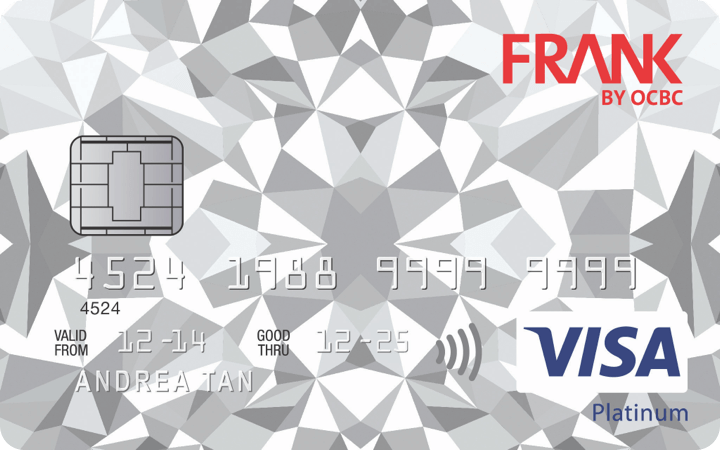

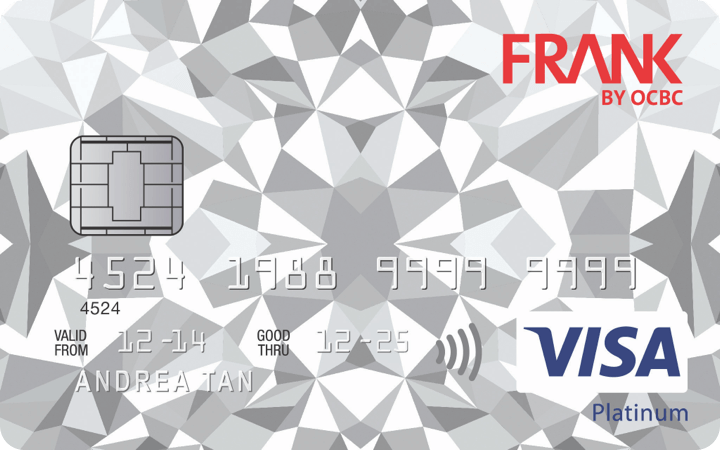

Effective 1 July 2020, new applicants for the FRANK Credit Card can choose between 2 designs � Obsidian (FRK2020) and Vortex (PRF0002). These 2 designs are also applicable for card design change requests for current Cardmembers. If you are an existing FRANK Credit Cardmember and wish to change your design, you can visit an open OCBC branch, or call our hotline +65 6363 3333. Please note that safety procedures are adhered to at OCBC Branches to ensure safe distancing during COVID. If you are an existing FRANK Credit Cardmember who is currently happy with your existing design, no further action is needed. Your card replacements will continue to be in your existing design.

How are the rebates calculated with S$25 sub-caps? To illustrate the S$25 sub-cap: Booking.com Online payment in FX In-store payment in FX Scoop Wholefoods Online payment in SGD Apple Pay / Google Pay in SGD Apple Pay / Google Pay in SGD *The maximum cashback a customer can receive per category is capped at S$25. Is FavePay considered an online or in-store mobile contactless payment transaction?A FavePay payment via the Fave app will be classified as an online transaction as the purchase is made through the internet via an app. Only Apple Pay, Samsung Pay, Google Pay, Fitbit Pay and Garmin Pay transactions will be classified under the in-store mobile contactless payments category.

What categories of spending are excluded from the minimum monthly spending and cashback calculations?

Certain Merchant Category Codes are excluded from cashback calculations and will not count toward the minimum spend requirement. Examples include: top-ups to e-wallets including that of Grab, Youtrip, Singtel Dash, tax payments, insurance premium purchases made to financial institutions.